Is Crypto Re-Creating the 2008 Financial Crisis?

Welcome to Galaxy Brain—a newsletter from Charlie Warzel about technology, media, culture, and big ideas. You can read what this is all about here. If you like what you see, consider forwarding it to a friend or two. This is a free edition of the newsletter, but you can subscribe to The Atlantic to get access to all posts. Past editions I’m proud of include: A 10-Year-Old Nuclear-Blast Simulator Is Popular Again, The Bad Ideas Our Brains Can’t Shake, How to Spend 432,870 Minutes on Spotify in a Year, and Confessions of an Information Hoarder.

Programming note: Galaxy Brain will be in the wild this week at The Atlantic's Disinformation and the Erosion of Democracy" event. You can check out the agenda here (I'm hosting a panel on Friday). You can stream it live starting at 3 p.m. CT Wednesday, 4/6 on The Atlantic’s website.

But most importantly: If you have any familiarity with Chicago, please email me and tell me where I need to go to eat food. I love food and I love suggestions about great places to eat food.

What I find most concerning about crypto/Web3 is that a great deal of the projects I’ve seen add unnecessarily complex financial elements to areas of our lives that didn’t have them before. Crypto critic Dan Olson recently described this ethos as the construction of an internet where “everything that can be conceptualized as valuable can be numeralized.” “Play to win” games like Axie Infinity, for example, are a dystopian vision of leisure that replicate exploitation we’re used to seeing in real life. I find myself more alarmed about the crypto’s hyper-financialized vision of the world each day but I also lack some of the historical knowledge necessary to offer a strong financial critique of the space. Which is why I was deeply fascinated when I came across an essay by American University law professor Hilary J. Allen titled “DeFi: Shadow Banking 2.0?”

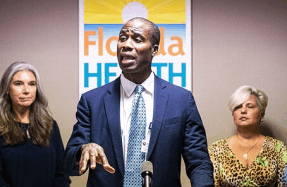

Allen studies financial crises—specifically, threats to financial stability and the ways in which financial fallout affects regular people, not just institutions—and she has testified before the House Financial Services Committee. Her recent essay focuses on the financial innovations (money market mutual funds, credit default swaps, mortgage-backed securities) that ultimately led to the 2008 crisis and draws parallels between those and some of the tools and dynamics in the world of crypto and decentralized finance (DeFi). DeFi, she argues, is

You’re reading a preview, subscribe to read more.

Start your free 30 days